- The ReFi Playbook

- Posts

- A Deep Dive into the world of Alts

A Deep Dive into the world of Alts

The unique qualities of alternative investments—such as their diversification benefits and low correlation with traditional asset classes—are making them increasingly attractive to investors.

A once exclusive asset class has emerged as a compelling avenue for diversification and unlocking new potential in Australia.

The Covid-19 pandemic bought to an end Wall Street’s 11-year bull market run. The S&P 500 dropped 34 percent in a month, marking one of the sharpest declines in history. With bond markets collapsing and interest rates at historical lows, an exclusive club of investors had access to investments that captured upside potential without going up the risk curve. These investments are known as “alternative investments” or private assets.

So, what are alternative investments, and how does an investor gain access?

According to the Australian Shareholder’s Association, “An alternative investment is an asset that is not one of the conventional investment types, such as stocks, bonds and cash. Alternative investments include private equity, hedge funds, managed futures, commodities and wine, art and collectibles.”

The unique quality of these investments is their diversification benefits, lower correlation to the standard asset classes such as equities and bonds. As a result, these investments grew in popularity during Covid to help offset market volatility and generate higher returns.

Global bond manager PIMCO noted, “Alternative investments can provide an interesting opportunity for investors to diversify their portfolios, dampen the impact of market volatility and help them achieve their long-term investment objectives, even during times of market uncertainty.”

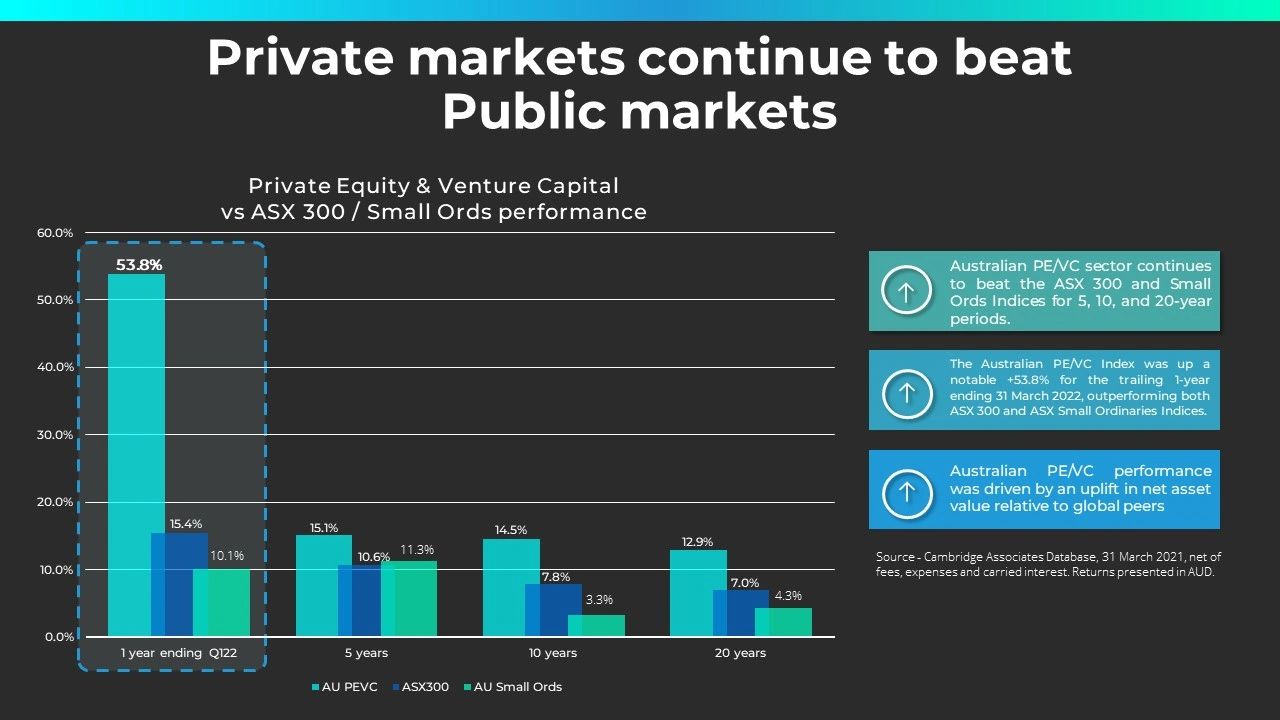

PIMCO expects traditional investments to only deliver a paltry 4 per cent per year over the next decade. For the 20-year period ending in 2022, private equity investments on average have returned 14.75%, compared to 9.25% for the S&P 500, making alternative investments an attractive asset.

Russell Investments is confident private markets will continue to grow and do well. The investment firm said it expects “to see the need for high private investment to finance resilient supply chains, future-proof assets, and build what is needed in the future.”

Once upon a time, alternatives were only offered to institutional investors, big super funds and the uber rich. While that may have been the case many years ago, things are changing. As the demand for alternatives rises, family offices and wealth managers are demanding access to alts for their clients. In Australia alternatives can only be accessed by wholesale & sophisticated investors or retail investors via their super fund.

The downside to this exquisite class of assets is the illiquidity and long investment lockup periods. Forbes says, “Alternative investments tend to be private, rather than public, and they are generally less liquid, typically with reduced liquidity ranging from monthly to 12+ years, so they may be difficult to exit and your money may be tied up for an extended period of time.”

However Platforms such as RegenX in Australia, Bite Investments in London, and, InvestaX in Singapore, are disrupting markets by actively solving these headwinds. These digital platforms not only focus solely on alternatives but solve illiquidity issues by creating a secondary market and remove accessibility barriers of the past.

With alternatives also gaining popularity among the millennial (Gen-Y) demographic, i.e. impact investments and renewable infrastructure funds, these risk-adjusted investments are becoming more and more attractive for every mum and dad portfolio, not just institutions.

Here is a short summary of the different types of Alternative Investments:

.png/:/cr=t:0%25,l:0%25,w:100%25,h:100%25/rs=w:1280)

Liquid Alternatives:

Hedge Funds: Hedge funds are investment vehicles that employ different strategies to generate returns, including long-short, event-driven, relative value, global macro, and risk premia. These funds provide opportunities to access various market trends and enhance portfolio diversification.

Illiquid Alternatives:

Real Assets: Investing in real assets like natural resources, commodities, and infrastructure provides exposure to tangible assets that can offer potential long-term value appreciation.

Private Equity: Private equity investments involve participating in privately held companies, providing capital to support growth and expansion. This asset class can deliver attractive returns over a longer investment horizon.

Private Credit: Investing in private debt securities, including mezzanine debt and direct lending, offers the potential for consistent income streams and capital preservation.

Real Estate: The real estate sector provides opportunities to invest in residential, commercial, and industrial properties, offering rental income potential and capital appreciation.

Infrastructure: Investing in infrastructure projects, such as transportation systems and utility networks, can provide stable cash flows and potential long-term value.

Art and Collectibles: Alternative investments in artwork, rare collectibles, and valuable assets can provide a unique store of value and potential appreciation.

Venture Capital: Supporting early-stage companies with high growth potential can lead to significant returns if successful.

Cryptocurrency: Investments in digital currencies like Bitcoin and Ethereum offer exposure to the growing blockchain and cryptocurrency market.

Structured Products: These complex financial instruments offer tailored risk and return profiles, catering to specific investment objectives.

Farmland: Investing in agricultural land for crop production or livestock breeding can provide opportunities in the food and agriculture sector.

As sophisticated investors look beyond traditional assets, alternative investments have emerged as a compelling option with exciting opportunities for investors in Australia. With the emergence of platforms like RegenX that leverage tokenisation, investors can unlock the potential of alternative assets, diversify their portfolios, and align their investments with sustainability objectives. As always, it's crucial to conduct thorough due diligence, seek professional advice, and stay informed to make informed investment decisions in the alternative investments landscape.