- The ReFi Playbook

- Posts

- Believers & Pragmatists: Shaping the Future of Impact Investing

Believers & Pragmatists: Shaping the Future of Impact Investing

A recent research report by leading wealth platform provider Netwealth, titled “Investing for Good | Advisable Australian Report 2022," detailed the modern investor's dual paths in the pursuit of financial returns alongside ethical considerations.

UN’s Climate Change Conference (COP28) recently concluded signalling the “beginning of the end” of the fossil fuel era, underpinned by emissions cuts and a scale up in impact investing with a sharp focus on two distinct investor types: the "Believers” and the “Pragmatists”.

A recent research report by leading wealth platform provider Netwealth, titled “Investing for Good | Advisable Australian Report 2022," detailed the modern investor's dual paths in the pursuit of financial returns alongside ethical considerations.

According to the report, “Advisers play a significant role in helping clients allocate capital both efficiently and, increasingly, in a socially responsible way”, by educating themselves and then passing this onto their clients.

Therefore it makes sense to understand the differences between those likely to invest, and those unlikely to invest, by looking at four groups Netwealth have created i.e. 1. Believers, 2. Pragmatists, 3. Doubters and 4. Sceptics.

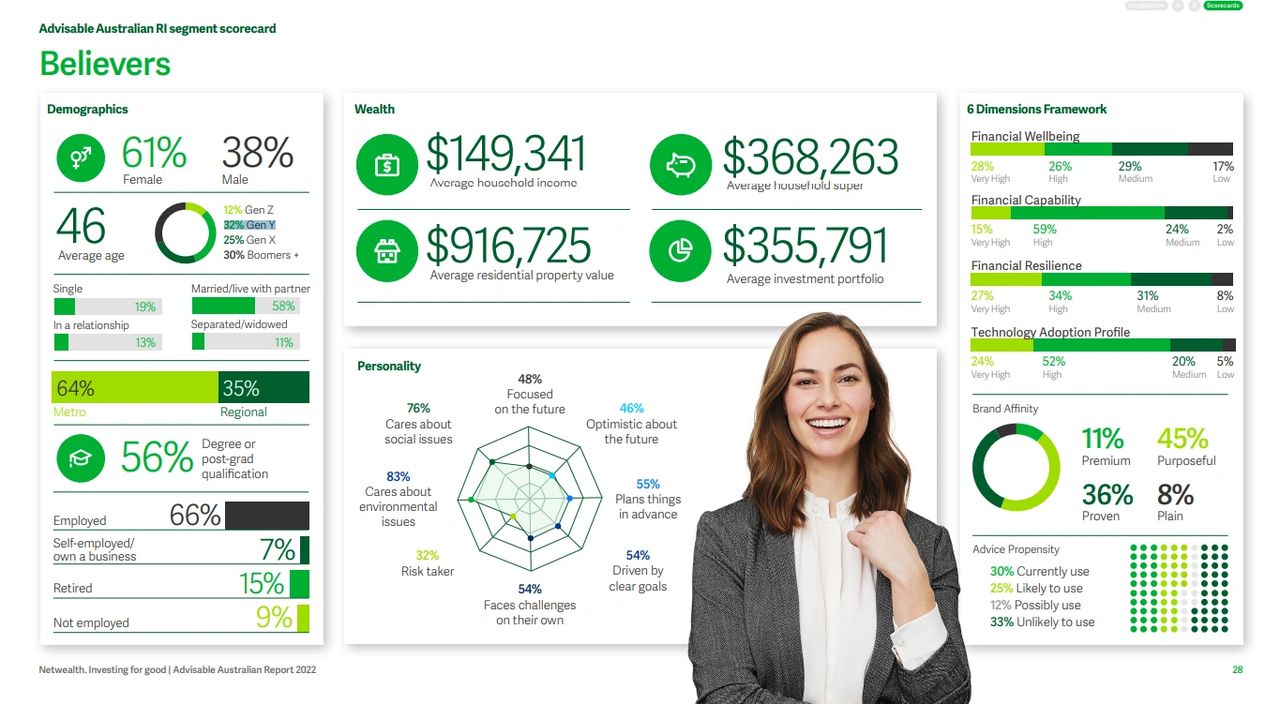

According to the report, the " Believer," is driven by a desire to make investments that resonate with their personal values. They are the heartbeats of impact investing—individuals who are just as committed to generating a positive social and environmental impact as they are to seeing their portfolios grow. With an average age of 46, Do-Good Innovators are not defined by a specific demographic but by a shared ethos. They are more often women (61%) and tend to be employed (66%), with an average household income of $149,341 and an investment portfolio averaging $355,791.

Source - Netwealth

This group is significantly motivated by the potential to enact change through their investments. As Netwealth's report points out, 85% of Believers without responsible investments would consider them if they made a quantifiable difference to the environment or society. They prioritise "doing good" over maximising profits and are inclined towards investments with clear, positive impacts.

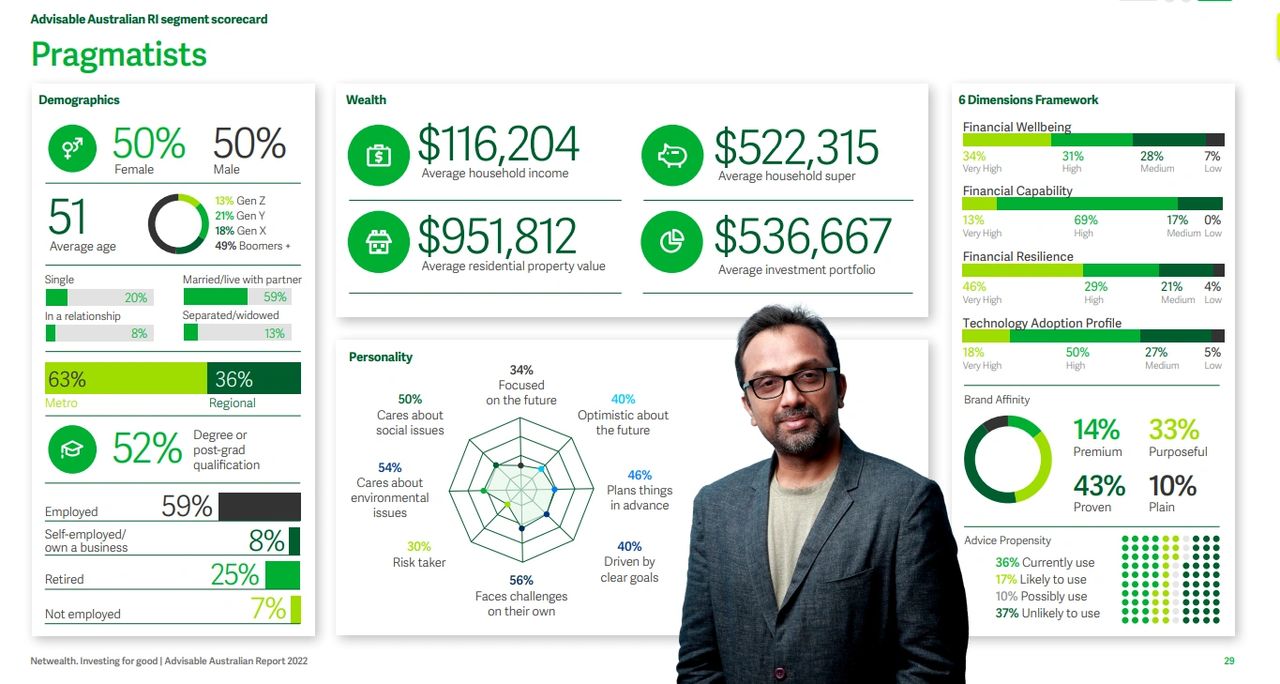

On the other end of the spectrum lies the “Pragmatist," typically a 51 years old, evenly split between genders, and slightly more likely to be from the Baby Boomer generation. With an average household income of $116,204 and a significant investment portfolio averaging $536,667, the Pragmatist is financially well-established with a focus on financial results. However, they are not necessarily driven by the prospect of responsible investments making a social or environmental impact like the Believer.

Netwealth’s report reveals that while 54% of Pragmatists care about environmental issues, they are more neutral when it comes to responsible investing, with 93% neither for nor against it.

For RegenX, the “Believer” represents an ideal customer. The platform’s commitment to environmental innovation aligns perfectly with the Believer’s goals. Their investment can directly contribute to technological advancements that tackle climate change or improve sustainability, offering the tangible impact these investors seek. RegenX’s could also appeal to the “Pragmatists” of the world, by emphasising the potential for impact investments to deliver as good, if not better, returns than traditional investments. The Pragmatist be swayed by the argument that responsible investing is not just ethical but also economically sound.

For the Believer, RegenX's portfolio of green technologies and sustainable projects provides the ethical alignment and potential for impact they desire. For the Pragmatist, the same portfolio offers a pragmatic investment in burgeoning industries poised for growth in a world increasingly driven by environmental concerns.

As we move forward, the insights from Netwealth's report are not just a reflection of the current market but a roadmap into the future of sustainable investing—a future where the Believers and Pragmatists may well become the standard persona for all investors.

Source - Netwealth