- The ReFi Playbook

- Posts

- 💸 Bitcoin Booms While Global Trade Wobbles | Your ReFi-Playbook Is Here

💸 Bitcoin Booms While Global Trade Wobbles | Your ReFi-Playbook Is Here

26 May 2025 - Your go-to source for the latest in tokenized RWAs, regenerative finance, and on-chain sustainability—covering market moves, economics, stock market announcements, crypto insights, and real-world impact deals, all in one place.

Welcome to the ReFi Playbook — by RegenX 🌿🔆

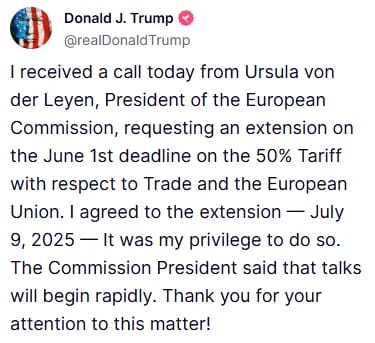

Global markets were down again with the S&P 500 falling for a fourth straight session and it’s all due to renewed worries about tariffs. A threat by US President Donald Trump to impose a new 50% tariff on European imports and a 25% tariff on Apple, have sparked selling across global equity markets with Wall Street falling on Friday. At the time of writing however, it seems after threatening this 50% tariff on all goods from Europe from June 12, Trump has now agreed to 'extend' the deadline to July 9.

In short, it looks like Trump’s up to his old games again. He tanks markets with new tariff threats against Europe and Apple and then backs off before they can come into effect. We think markets may be growing immune to Trump’s tariff threats with investors appearing to be increasingly dismissive, viewing these announcements as short-lived or political posturing.

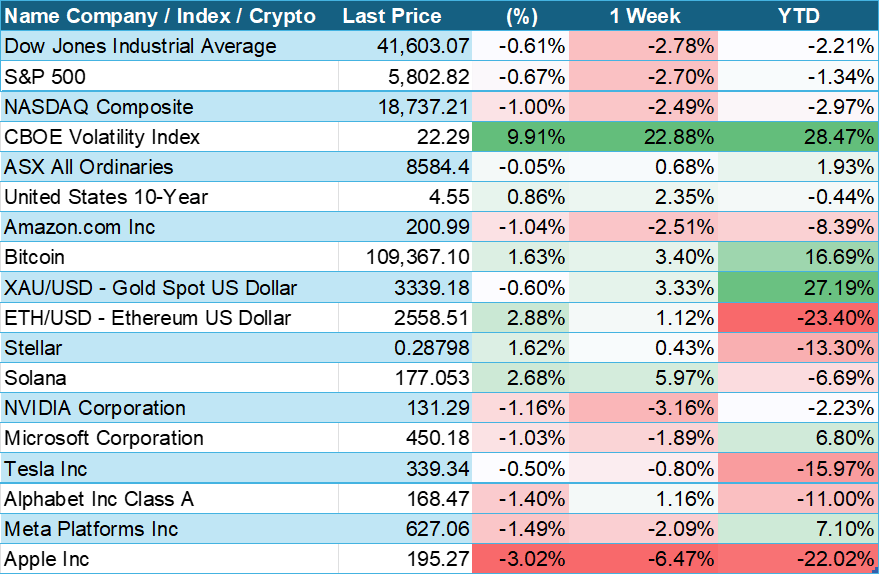

Trump Truth Social post (Truth Social)

Despite all the tough tariff talk, Bitcoin continues to push higher and higher. It’s clear now that Bitcoin has significantly outperformed the NASDAQ Index. In early 2025, Bitcoin and the NASDAQ showed moderate positive correlation, moving largely in tandem through January and February. However, by late April into May, Bitcoin broke out sharply, gaining over +13.7% YTD, while NASDAQ posted a more modest +3.5% return. This divergence suggests a decoupling of risk appetite, with Bitcoin attracting momentum capital likely driven by macro uncertainty, inflation hedging, or demand for alternative stores of value. Bitcoin continues its bullish momentum, setting new all-time highs and contributing to a surging crypto market cap of $2.21 trillion.

TradingView

Here’s what we’ve got for you today:

Market Rundown

Global Headlines

Chart of the Day

Education: Article of the Day

Events & Pitches

Market Rundown

Data as at 26 May 2025

Global Headlines

US stock markets closed lower last week with the main US benchmarks closing down 2.78% last week on the back of renewed concerns regarding Trump’s trade tariffs on the EU and Apple.

Despite Friday’s close, the ASX 200 has opened flat this morning after Trump and the EU appeared to have pushed out trade negotiations until Juny 9. The miners along with energy stocks are in the green while retailers, healthcare and utility are in the red.

Uranium stocks are in the green this morning after US President Trump issued an executive order to restart the US nuclear industry late last week.

Elders shares are up after the agribusiness trader and supplier posted a 190% rise in first half profit to $33.6 million.

Oil is drying up in the US - According to media reports, the Baker Hughes rig count survey has shown that US energy firms have slashed the number of oil and natural gas rigs to the lowest level since late 2021.

Economic Data due for release this week

Australia - On Wednesday the monthly CPI indicator for April is due for release. The headline inflation is expected to fall to 2.3% over the year while trimmed medium inflation is tipped to remain firm at 2.7%, within the RBA's 2-to-3% target band.

US - Mon: US — Memorial Day holiday (markets closed). Tue: Durable goods (Apr), Home prices (Mar) & Consumer confidence (May). Fri: US — PCE inflation (Apr), Advanced goods trade balance (Apr)

Chart of the Day - Apple looking oversold

Donald Trump has threatened a 25% tariff on iPhones and Samsung phones not made in the US. This puts significant pressure on Apple to move its production back to the US. His comments, almost instantly wiped off $70 billion from Apple’s market value and sent shares tumbling. Apple closed trade -3.02%. Apple shares are down 22% year to date. Trump warned that all phones sold in the U.S. must be made domestically, rejecting Apple’s recent move to shift U.S.-bound iPhone assembly to India. He extended the tariff threat to Samsung and other foreign manufacturers, saying “it wouldn’t be fair” otherwise. Trying to relocate iPhone production will not only take significant time but it would also mean iPhone production would be prohibitively expensive, tripling the retail price to $3,500 per device.

Our thoughts: Based on Trump’s past behaviour, we expect him to eventually walk back these threats as cooler heads prevail. It appears the administration's goal is to pressure Apple to shift production away from China, rather than actually implement tariffs. We don’t believe these tariffs will be enforced, as the broader economic fallout would be significant. Looking at the chart below Apple is at a technical inflection point. A breakout above the descending resistance could shift momentum bullish, with targets in the $220–$240 range. However, traders should watch for confirmation with volume and macro headlines, particularly related to tariffs and supply chain developments. At these levels, we think Apple is good value.

What’s happening in the world of RWA?

According to an article in the AFR, Australia has seen its first major regulatory casualty in the crypto space, with a federal court ruling in ASIC’s favour against Block Earner for offering an unlicensed financial product to retail investors. Interestingly, the court allowed a second Block Earner product, one that simply connected users directly to decentralised finance (DeFi) protocols without managing their funds, to continue operating, ruling it did not fall under Managed Investment Scheme (MIS) regulations. The outcome underscores ASIC’s intent to apply existing financial laws to crypto offerings, while also suggesting that certain non-custodial DeFi services may lie outside current licensing requirements.

RWA World and Seda released a report titled, “Programmable RWAs. How Oracle Tecnology enables Real World Tokenization”. Here are some of the highlights from the report:

The Real-World Asset (RWA) tokenization market is estimated to surpass $16 trillion by 2030, with rapid institutional adoption beginning now.

Current market size (as of 2025) is in the low hundreds of billions, but growing fast as major financial products (e.g., treasuries, credit, commodities) move on-chain.

🏦 Key Players

BlackRock: Launched a tokenized fund (“BUIDL”) on Ethereum via Securitize.

Securitize, Figure Markets, and Ondo Finance: Leading platforms enabling tokenized access to treasuries and private credit.

Plume Network, Credible Finance, SEDA, and Matrixdock are emerging infrastructure and data layer players.

Government-led sandboxes: Projects in Singapore, Dubai, EU, and Hong Kong are piloting tokenized finance at a regulatory level.

📈 Market Projections

$16 trillion by 2030 (McKinsey projection) across tokenized financial assets.

Major near-term growth areas:

Tokenized US Treasuries

Private credit

Commodities like tokenized gold

Carbon markets and sustainability assets

According to Blockworks Research, the next major opportunity in crypto lies in tokenizing private equity, not public stocks. Analyst Carlos Gonzalez Campo argues that private markets, plagued by high barriers and illiquidity, stand to benefit most from blockchain-based fractional ownership. Platforms like Ondo Chain and Converge are already emerging to meet this demand by aligning with regulatory frameworks, and the report predicts that shares in high-growth private companies such as SpaceX and OpenAI could be tokenized within the next four years.

Sparks of Curiosity

"We're not here to disrupt for the sake of disruption. We're here to build trust, unlock transparency, and enable liquidity where it never existed — using blockchain as a tool, not a buzzword."

— Ishan Dan, Founder & CEO of ReGenX, on Sparks of Curiosity

In this episode, Ishan breaks down how blockchain can drive real-world impact in climate investing — beyond the hype, beyond the jargon. If you're curious about Web3, sustainable finance, or what the future of green infrastructure investing looks like, this one's for you.

🎧 Listen now: https://lnkd.in/gavX_hVj

RegenX is Pitching at RMIT’s Pitch Night

RegenX invites you to join us at the RMIT Activator [Re]Launch Pre-Accelerator Pitch Night!

After 12 weeks of development, RegenX is proud to be one of ten high-impact startups pitching bold, scalable solutions to some of the most pressing climate and infrastructure challenges of our time.

We’re building the future of clean energy investment — unlocking access, transparency, and liquidity for climate-positive infrastructure through tokenized ownership and community co-investment.

Come along to hear our pitch and connect with other founders, investors, and innovators driving Australia's transition to a circular and sustainable economy.

📅 Date: Wednesday 11 June 2025

🕔 Time: 5:00 pm – 8:00 pm

📍 Location: Isabella Fraser Room, State Library Victoria (Entry 5), 179a La Trobe Street, Melbourne VIC 3000

Why attend?

Hear RegenX’s vision for transforming clean energy investing

Explore circular economy solutions from Australia's most promising startups

Connect with fellow investors, industry experts, and ecosystem partners

Discover how RMIT Activator is backing the next generation of impact-driven founders

Tickets are free, but places are limited — join us for an evening of purpose-led innovation, networking, and light refreshments. Click here to register now.

Thanks for reading this week’s edition of the ReFi Playbook. I appreciate you being part of this growing community of builders, investors, and changemakers shaping the future of climate finance. If you found value here, feel free to forward it to a friend or colleague who might be curious about the world of tokenized RWAs and regenerative finance. And if you haven’t already, make sure to subscribe so you don’t miss the next drop. Until then, stay curious, stay regenerative. 🌱

Ishan

Founder, RegenX