- The ReFi Playbook

- Posts

- Buzzing with Tokenisation

Buzzing with Tokenisation

Tokenisation is permeating Australia's financial landscape as the new buzzword amongst the crypto world.

Australia’s leap into the digital asset revolution: Tokenisation is permeating Australia's financial landscape as the new buzzword, with initiatives like RegenX leading the way in transforming digital assets and spearheading innovations to democratise and liquify the private markets in the region.

And just like that, the once-booming world of Non-Fungible Tokens (NFTs) and cryptocurrency has experienced a precipitous collapse, painting the market red with widespread losses.

According to a report by dappGambl based on data provided by NFT Scan and CoinMarketCap, “95% of people holding NFT collections are currently holding onto worthless investments. Having looked into those figures, we would estimate that 95% to include over 23 million people whose investments are now worthless.”

However, the chapter of cryptocurrency is far from closed. On the contrary, we stand on the precipice of a new era in the tale of cryptocurrency – the advent of tokenisation and distributed ledger technology, poised to unveil unprecedented opportunities and instigate disruptions.

Tokenisation has emerged as the new buzzword among the finance suits. There has been much talk about the tokenisation of real-world assets (RWA) and bringing them on chain. For those that don’t know, tokenisation of real world assets is the fractional ownership by investors through the division of assets into smaller, more affordable tokens to a more accessible to a wider variety of investors.

Australia’s big four banks are abuzz with the idea of digitising traditional assets on the balance sheet and are exploring the concept. Rather than using a public chain such as Ethereum, the big banks will look to build their own private versions of the blockchain.

In the past, traditional finance once saw blockchain as "highly risky" because of price unpredictability and susceptibility to fraud. One solution was to develop stablecoins in an attempt to create a cryptocurrency token with a stable price. The stability achieved by pegging the token to an asset such a gold or a fiat currency.

An article by research giant McKinsey & Co underscores, “Tokenisation as potentially a consequential deal. Industry connoisseurs have projected up to $5 trillion in tokenised digital-securities trade volume by 2030.”

According to the report, “tokenisation has the potential to reshape the architecture of financial services and capital markets, enabling asset holders to harness the advantages of the blockchain.”

Some of the main benefits include:

Faster transaction settlement, fuelled by 24/7 availability.

Operational cost savings, 24/7 data availability and asset programmability.

Democratisation of access.

Enhanced transparency powered by smart contracts

Cheaper and more nimble infrastructure.

Who are the providers in this space?

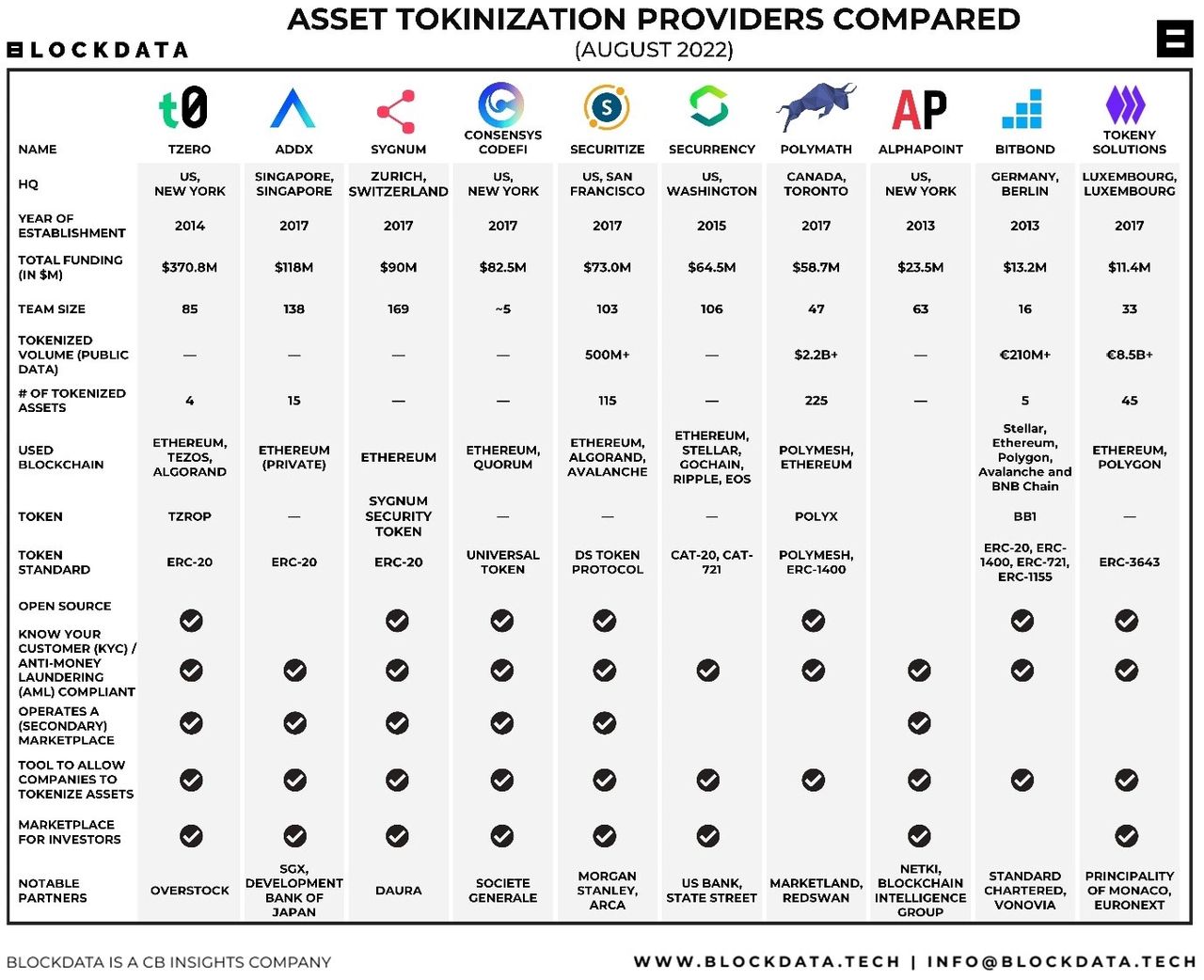

While ANZ and NAB are developing platforms, Australia's tokenisation scene is still in its infancy. Conversely, international contenders in the US and Singapore have made substantial headway in tokenisation. We've Data from Blockdata lists the top 10 asset tokenisation companies in the table below.

Institutions, banks, and fund managers are observing with keen interest as tokenisation commences its infiltration into the mainstream market, revealing a burgeoning niche that demands consideration from wholesale and institutional investors.

Embark on a transformative journey into the realm of asset tokenisation with RegenX. Tailored for wealth managers and family offices, RegenX is an innovative platform that effortlessly merges digital ledger technology with streamlined investment opportunities. Experience an unparalleled blend of accessibility and financial inclusivity in alternative investment markets and explore the next frontier of investment strategies. Start navigating the future of tokenised investments at RegenX.io.