- The ReFi Playbook

- Posts

- From Pizza to Paradise, how Bitcoin Hypnotised the World

From Pizza to Paradise, how Bitcoin Hypnotised the World

Bitcoin, the most notable of cryptocurrencies, has captivated and bewildered investors since its mysterious launch in 2009.

Bitcoin, the most notable of cryptocurrencies, has captivated and bewildered investors since its mysterious launch in 2009. Its price history reflects a wild rollercoaster ride, earmarked by periods of explosive growth and crushing collapses. In this article we look at the factors that have driven Bitcoin's price movements, focusing on investor sentiment, risk assets, global money supply liquidity, and the surprisingly entangled role of the US Federal Reserve. We will also delve into the concept of Bitcoin halving, a built-in feature that has historically impacted price movements, and explore the possibility that this effect may be waning.

Early Days: From Rags to Riches

Bitcoin's price began as close to zero as one could imagine. The first documented real-world purchase, two pizzas for 10,000 BTC in 2010, now represents a legendary tale for early sceptics. However, the tide began to turn in 2011, fuelled by growing interest and hype. The price surged to a high of $30, only to plummet back down later that year. This early volatility established a pattern that would define Bitcoin's future, creating stories of millionaires made overnight and tales of fortunes lost in seconds. Yet, this rollercoaster ride continues even today. As prices climbed in 2011, the fear of missing out (FOMO) took over, driving even more speculation and pushing the price even higher. This boom-and-bust cycle became a hallmark of the early adopters who struck it rich and the greater fools that lost it all.

Investor Sentiment: “Buy Buy Buy, Sell Sell Sell”

One of the most significant factors influencing Bitcoin's price is investor sentiment. Bitcoin thrives on positive media coverage and enthusiastic adoption. News of Elon Musk investing in Bitcoin, or the launch of a Bitcoin exchange-traded fund (ETF), can push demand higher, sending prices skyrocketing. On the flip side, negative news, such as regulatory crackdowns or rising inflation, can lead to panic selling, weaker demand and price crashes, as we saw during COVID. Bitcoin's price is highly sensitive to public perception, making it a volatile, prone to move on herd mentality.

Correlation with Risk Assets: Birds of a Feather?

Bitcoin's relationship with traditional risk assets like stocks has been a topic of much debate. Initially, Bitcoin was seen as a hedge against traditional markets, a "safe haven" during economic downturns. “Digital Gold” - Often dubbed the alternative to gold. However, over time, it lost this correlation and one between stocks emerged, particularly with technology stocks. This suggests that Bitcoin may be increasingly seen as a high-growth, high-risk asset, like technology stocks. A good example is NVIDIA, to which there is a highly correlation.

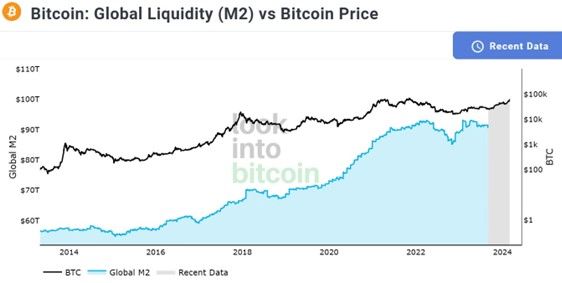

Global Money Supply Liquidity and the Quest for Yield

Central banks around the world have implemented quantitative easing (QE) programs in recent years, injecting vast amounts of liquidity into the global financial system. This abundance of cash has undoubtedly played a role in Bitcoin's price appreciation. Yield hungry investors, have turned to alternative assets like Bitcoin. However, as inflation start to rise post-COVID, central banks began to tighten and raise interest rates, causing people to spend less. This triggered a bout of selling, collapsing Bitcoin's price.

The Federal Reserve: Sceptic to Believer?

The narrative around the Federal Reserve and Bitcoin has been one of total opposition. However, a recent development has everyone scratching their heads. The Federal Reserve is now estimated to be the second-largest holder of Bitcoin with rumours of it holding well over 200,000 Bitcoins seized from criminals. The Fed's emergency liquidity measures during the COVID-19 pandemic, also included bailing out financial institutions heavily invested in crypto-asset firms. In essence, these seizures have created a massive government stash of Bitcoin, which came at no cost. And, unlike other crypto whales or institutions, the Fed doesn’t care if Bitcoin goes up or down in value.

The Institutional effect

The arrival of Bitcoin ETFs and institutional investment has significantly impacted Bitcoin's price and overall market perception. ETFs, which track the price of Bitcoin without the need for direct ownership, have opened the door for a wider range of investors, including traditional institutions, to gain exposure to cryptocurrency. This flood of institutional money, often much larger investment sizes, can lead to increased buying pressure, potentially driving the price up, as we’ve seen over the last month with bitcoin hitting US$100k. Additionally, the involvement of established institutions lends a sense of legitimacy to Bitcoin, potentially attracting more retail investors and further boosting the price.

However, the impact of institutional investors has its downfalls. While their presence can bring stability, it also introduces a new layer of risk sensitivity. Unlike early Bitcoin adopters, who often hold a significant portion (if not all) of their wealth in Bitcoin, institutional investors typically allocate a small percentage, typically ranging from 5% to 7% of their overall portfolio, to this volatile asset class. This smaller allocation is often viewed as a speculative, "risk-on" investment. As a result, when investor sentiment changes and the market turns, institutional investors exit these riskier positions first compared to the more stable positions. This goes against the "hodling" mentality of many original Bitcoiners and can trigger a wave of selling pressure that can exacerbate price downturns.

The Halving Effect: It’s coming... or is it?

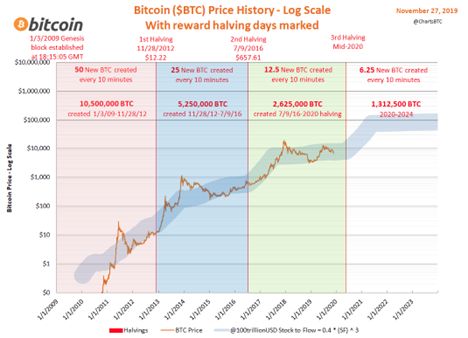

Bitcoin's price history is intertwined with a unique feature: the halving. Roughly every four years, the number of Bitcoins rewarded to miners for verifying transactions is cut in half. This automatic feature to enact scarcity is hardcoded to control the overall supply of Bitcoins and combat inflation. Historically, these halving events have preceded significant price increases because of the anticipation of reduced supply. Coupled with media coverage, it fuels a bull run in the months following each halving. For instance, the price of Bitcoin surged after the first halving in 2012 and again in 2016. The most recent halving occurred in May 2020, and Bitcoin reached its all-time high of nearly $69,000 in November 2021.

Buy the Rumour, Sell the Fact: A Waning Halving Effect?

This old share market adage suggests that investors often price in an anticipated event beforehand, leading to a price increase before the event itself. Then, when the event happens, the price may fall as investors who bought in anticipation take profits. In the context of Bitcoin halving’s, we believe that the market has become more efficient in recent years. The previous halving events occurred during a period of awareness and limited institutional involvement. Now, with institutional investors at the helm, the price may already reflect the anticipation of a reduced supply.

The Double Edged Sword: Bitcoin can crash quicker than any other asset

The mass inflow of institutional money and ETFs funds i.e. Blackrock, has created a double-edged sword for price stability. While they've provided legitimacy and boosted the price, they've also introduced the potential for faster, more dramatic crashes. Unlike individual investors who might hold on during dips, large institutions with stricter risk management protocols will exit positions quickly when sentiment changes. This herd mentality among institutional investors, amplified by automated trading algorithms, can trigger massive sell-offs. A prime example is the 2020 crash, where Bitcoin plummeted over 60% in a single month as the COVID-19 pandemic unfolded. This rapid decline demonstrates how quickly sentiment shifts can translate into price drops when institutional money is involved. Without circuit breakers, the increased liquidity from these institutional investors can accelerate both upward and downward spirals, making Bitcoin potentially more susceptible to sharp corrections compared to its earlier years.

Conclusion: It’s a whazy, It’s a woozie but we love it

Bitcoin's price journey has been a rollercoaster ride, captivating, and confounding investors in equal measure. A mishmash of influences including investor sentiment, halving’s, and movement in global money supply, have all served as powerful drivers. However, this is changing. Bitcoin is becoming increasingly entangled with traditional financial markets, central bank actions, macroeconomic forces, and even the risk tolerance of institutional investors. As Bitcoin matures and regulations evolve, the dramatic price swings historically influenced by these factors might become more predictable. This could lead to an unfortunate shift in Bitcoin's behaviour.

But why unfortunate?

Bitcoin may start to resemble a volatile Nasdaq share price, albeit lacking the safety nets of circuit breakers and government interventions. This heightened volatility could see Bitcoin experience rapid freefalls within seconds, especially if a major institutional investor sold a large holding in response to negative news or a "buy the rumour, sell the fact" scenario. A 60% crash, similar to what we witnessed in 2020, could become a more realistic possibility. However, the equation isn't entirely bleak. The US government's indirect stake through seizures could potentially act as a floor price, offering some support during significant drops. Either way, it’s unfortunate because the one thing we love about Bitcoin, is its unpredictability.

Our Prediction?

Ultimately, the future of Bitcoin's price remains anyone's guess. And that's precisely why it’s so appealing. Its wild swings, its unpredictable movements, and the rags-to-riches stories have captivated minds and hearts unlike any traditional investment. Bitcoin has become the ultimate lottery ticket for the digital age, promising astronomical gains but also carrying the potential for crushing losses. It's a gamble, a high-stakes dopamine game that thrives on volatility fuelling the insatiable human desire to chase the next big thing. And that, perhaps, is the most captivating part... it’s unpredictability.

Whether Bitcoin will continue its astronomical rise to become a mainstream financial asset or fade into the oblivion, remains to be seen.

One thing's for sure: its journey has been and, hopefully, will continue to be a thrilling, unpredictable journey, captivating both believers and sceptics for years to come.