- The ReFi Playbook

- Posts

- Regenerative Finance is a Game Changer for Australian Investors

Regenerative Finance is a Game Changer for Australian Investors

A new investment approach coined ‘Regenerative Finance (ReFi)’, could hold the key to solving Australia’s Ne Zero goals

A new investment approach coined ‘Regenerative Finance (ReFi)’, could hold the key to solving Australia’s Ne Zero goals, addressing both the massive amount of funding required and the urgent need for clean energy investment.

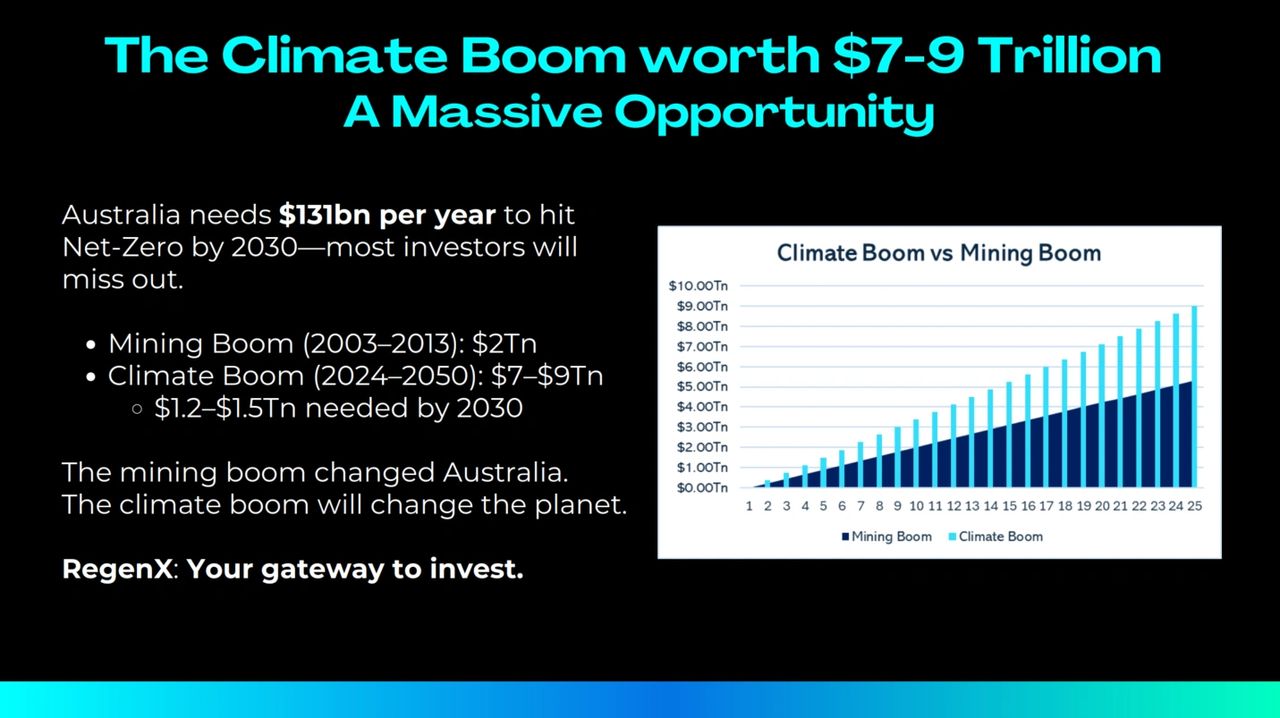

"For Australia to reach net-zero by 2050, investment of approximately $131 billion per year will be required to decarbonise across sectors like energy, transport, and agriculture,” that’s according to the Investor Group on Climate Change report, ‘Investing in Resilience: Accelerating Climate Action Across Australia's Economy.’

When projected through to 2050, this annual requirement equates to a total of approximately $3.40 trillion and “around $7-9 trillion of capital will need to be committed to domestic and export energy and industrial infrastructure by 2060,” according to the Net Zero Australia Project.

With the Responsible Investment Association Australasia (RIAA) projecting impact investment to reach $100 billion by 2025, demand for impact investments is rising. Yet, private capital still struggles to reach the climate-positive projects that need it most.

Ishan Dan, Founder and CEO of ReFi investment platform RegenX, explains, “The reason is that traditional investments labelled as ‘green’ or ‘sustainable’ often fall short of delivering real impact. Recent investigations have shown that many so-called ‘green’ funds invest in fossil fuel companies or other industries with significant negative environmental impacts.”

A recent report by Greenpeace Australia Pacific cited that over half of Australia's top 80 emitting ASX200 companies have set net-zero or carbon-neutral targets, yet many lack concrete plans to reduce fossil fuel use, indicating potential greenwashing practices.

“This lack of transparency makes it difficult for investors to identify truly sustainable opportunities. Traditional impact investments often come with high minimum investment requirements, excluding many Australians who are interested in making a positive impact but lack the capital to participate in larger deals” says Dan.

“Even when accessible, traditional investments frequently provide limited insight into how funds are used or what measurable impact they achieve.”

ReFi addresses the pain points of traditional investment models that prevent the flow of private capital by focusing on “doing more good,” shifting away from “doing less harm” to create a pathway for investors to actively participate in restoring the planet.

Unlike traditional investment finance that focuses on short-term gains and often overlooks environmental and social impacts, regenerative finance aims to create long-term, positive environmental and social outcomes all while creating economic value for investors.

The other issue is trust and confidence, often cited as a major concern with current investment strategies because of greenwashing and limited transparency.

ReFi solves this issue by using technologies like Digital Ledger Technology (DLT) and digital monitoring, reporting, and verification (dMRV) to provide real-time, measurable data on the impact of each investment project. Through tokenisation, ReFi enables fractional ownership of assets, making each investment traceable on a public ledger, which ensures that investors have clear visibility into how their funds are being used and what environmental outcomes are achieved.

This level of transparency allows investors to track the measurable impact of their contributions, significantly reducing the risk of greenwashing and building trust in the investment’s authenticity and effectiveness.

According to the Bank for International Settlements, "Projects can integrate real-time tracking and disclosure of green output for investors, showcasing technologies that can be used to reduce greenwashing and increase transparency."

Put simply, investors have clear insight into where their money is going and how it’s being used and the environmental outcome it achieves.

ReFi allows investors to allocate their capital toward projects that directly support Australia’s climate goals, such as reducing carbon emissions and conserving biodiversity aligning perfectly with Australia’s environmental and economic landscape.

What about returns?

ReFi is designed to generate not only financial returns but environmental benefits as well. Carbon credits, biodiversity credits, and impact tokens represent new asset classes that allow investors to earn returns while supporting regenerative projects.

Let’s take for example a large-scale solar farm in regional Australia that produces clean energy for local communities listed on ReFi investment platform, RegenX. Using the ReFi model, investors can invest directly into the project and receive a portion of the revenue generated from selling electricity to the grid, which provides them with regular financial yield of 9%.

In addition to this, the project also earns carbon credits by offsetting emissions that would have otherwise come from fossil fuel power sources. These carbon credits can be bundled with the investment, allowing investors to either sell them in the carbon market for additional revenue or retain them to offset their own carbon footprint. This dual benefit of yield plus carbon credits highlights how regenerative finance works on RegenX and how it can generate both environmental and economic returns.

And it’s not just clean energy projects, biodiversity projects in Australia are exploring the use of biodiversity credits, which reward investors for protecting ecosystems. By funding conservation efforts in regions like the Great Barrier Reef and native bushland, regenerative finance can enable Australians to support biodiversity preservation while diversifying their investment portfolios.

As the demand for impact investments continue to rise, Australia needs a new investment model that helps bridge the Net Zero funding gap by allowing private investment capital to enter the mix. By offering transparency, accessibility, and measurable impact, ReFi has the potential to address this problem by solving the challenges that have plagued traditional investment strategies.

Australia’s climate journey is just beginning, and regenerative finance is ready to lead the way.