- The ReFi Playbook

- Posts

- 🚨Trump U-Turns on Tariffs but is the Damage already Done? | ReFi-Playbook

🚨Trump U-Turns on Tariffs but is the Damage already Done? | ReFi-Playbook

14 April March 2025 - Your go-to source for the latest in tokenized RWAs, regenerative finance, and on-chain sustainability—covering market moves, economics, stock market announcements, crypto insights, and real-world impact deals, all in one place.

Welcome to the ReFi Playbook — by RegenX 🌿🔆

Hi, I’m Ishan — founder of RegenX and curator of the ReFi Playbook. Whether you’re new here or have been following since our first issue, thanks for tuning in.

The ReFi Playbook is your insider look at the fast-growing world of tokenized real-world assets (RWAs) for climate-positive projects. Each week, I share a curated mix of market moves, project deals, and tools driving the intersection of sustainable finance, Web3, and regenerative finance (ReFi).

Our goal is simple: help you navigate this evolving space with clarity, purpose, and impact.

If this isn’t for you, feel free to unsubscribe anytime — but if you’re curious about where tokenization and climate investing meet, you’ll want to stick around.

My Thoughts:

US stocks are rebounding after a turbulent week on Wall Street, as investors digest fresh developments in the US and China trade dispute. President Trump has removed tariffs on mobile phones, laptops, and semiconductors, surprise surprise, a move expected to boost tech stocks such as Apple and NVIDIA. This follows his announcement of a 90 day pause on tariffs for around 75 countries, while sharply increasing tariffs on China to 145 percent.

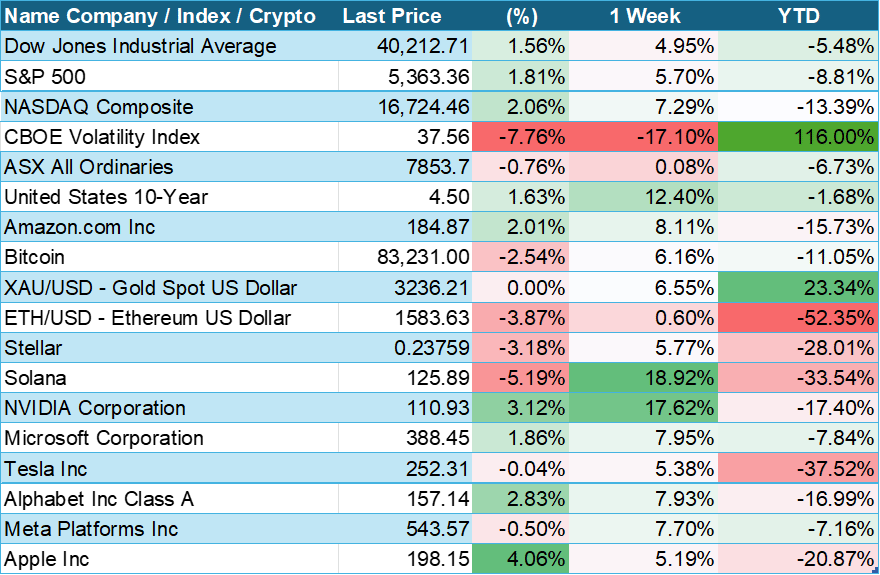

The S&P 500 and Dow posted their strongest weekly gains since 2023. The Nasdaq jumped 7 percent, up 12.16 percent on April 9, marking its best week since 2022. Meanwhile, gold surged past a record 3,200 dollars per ounce, and bond markets continued to sell off, with 10 year Treasury yields reaching their highest level since February, climbing higher towards 5 percent. Investors are beginning to question the safe haven status of US debt, with the bond market reacting strongly to the uncertainty surrounding trade policy.

While market volatility remains, it appears cooler heads are beginning to prevail in the Trump administration. Just days after stating that escalating tariffs on China would bring iPhone production back to the US, the administration has made a sharp reversal.

This morning, a global tech market research firm reported that around 80 percent of Apple’s iPhones intended for US sale are produced in China. If the tariffs had continued, Apple would likely have needed to raise prices beyond US$2,000 dollars per phone to preserve profit margins.

As of Monday morning, our local market is up nearly 1 percent, and Bloomberg Dow Jones Futures are pointing to a 141 point gain at the open.

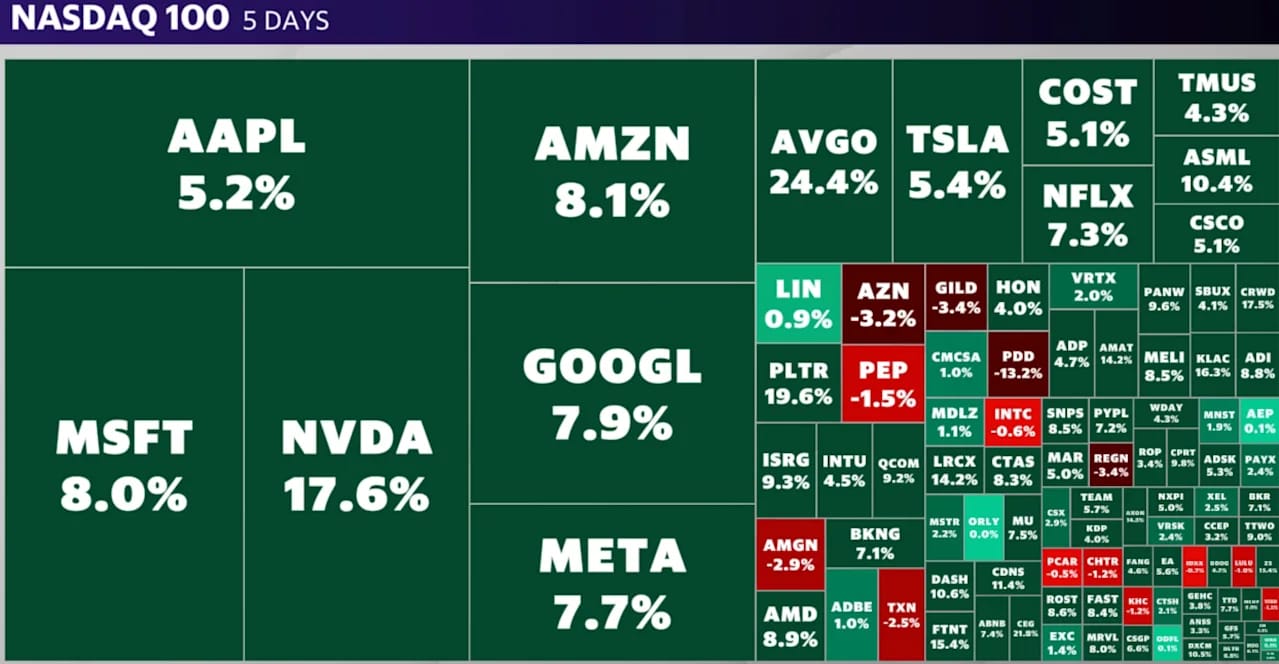

Below is a heat map of last week’s trading activity. While the media is painting an optimistic picture, suggesting that shares have recovered since last Wednesday and opened positively again today, we urge investors to be cautious. The market hates uncertainty.

After ten days of turmoil, one must ask: with such extreme policy flip flops, why would any nation feel confident negotiating with the US right now?

Source - yahoo finance

Here’s what we’ve got for you today:

Market Rundown

Global Headlines

Chart of the Day

Education: Article of the Day

Events & Pitches

Market Rundown

Global Headlines

US stock markets finished higher on Friday night, with the S&P 500 and Dow posting best week since 2023. The Dow closed +5.92 percent and the NASDAQ closed +7.19 percent.

Gold continued to climb higher rallying past US$3,200 and sending most US gold stocks up 3-5 percent.

China raises its tariffs on US imports to 125% from 84% and will “resolutely counterattack and fight to the end”

Trump then moved to exclude Chinese smartphones, routers, semiconductor equipment, and laptops from tariffs.

US April consumer sentiment tumbled to 50.8 vs. 54.0 estimates. It's the lowest level since Jun-22 with consumers expecting inflation to surge in the year ahead.

New York Fed president John Williams on Friday said he expects economic growth to slow this year to "somewhat below 1%" and inflation to rise to somewhere between 3.5% to 4%.

Chart of the Day

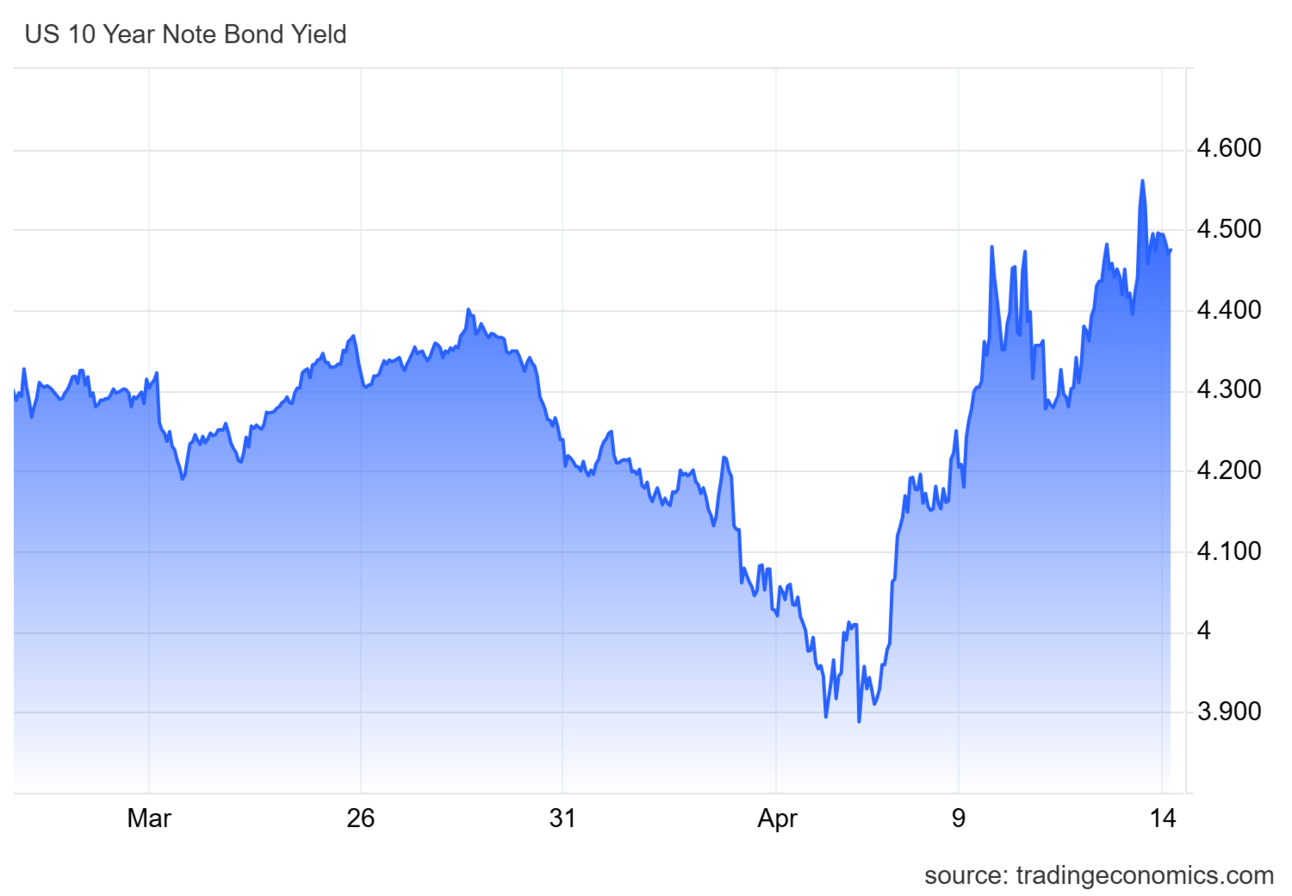

US 10 year Bond Yield chart — 14 April 2025

Below is a chart showing the 10 Year US Bond Yield. Why is this important?

This chart shows how much interest the US government has to pay when it borrows money for 10 years and that’s why its called the "10-year bond yield." It's important because it affects everything from home loan rates to how much businesses pay to borrow money. Last week, that interest rate jumped a lot, from 3.87% to 4.53%, which is a big deal in finance. It means investors are nervous about the economy, rising prices, or government decisions. When this rate moves quickly, it can shake up the whole market, including stock prices, loans, and even how confident people feel about the future.

When bond yields go up, it means borrowing money becomes more expensive for both people and the government. For everyday people, this leads to higher mortgage rates, more expensive car loans, and pricier credit card interest, which can reduce spending and make it harder to afford big purchases. For the government, higher yields mean it has to pay more interest on the money it borrows, increasing the national debt cost and leaving less money for things like healthcare, education, or infrastructure. Overall, rising yields can slow down the economy and make financial conditions tighter for everyone.

As you can see below, long-term Treasury yields rose last week, from a low of 3.87% on Monday to 4.53% by Friday. That’s a dramatic 66 basis point swing. This marks the biggest weekly move for the 10-year since November 2021. This sudden rise reflects growing investor anxiety over trade uncertainty, inflation expectations, and the safe haven status of US debt. Bond markets are clearly on edge — and that’s worth watching.

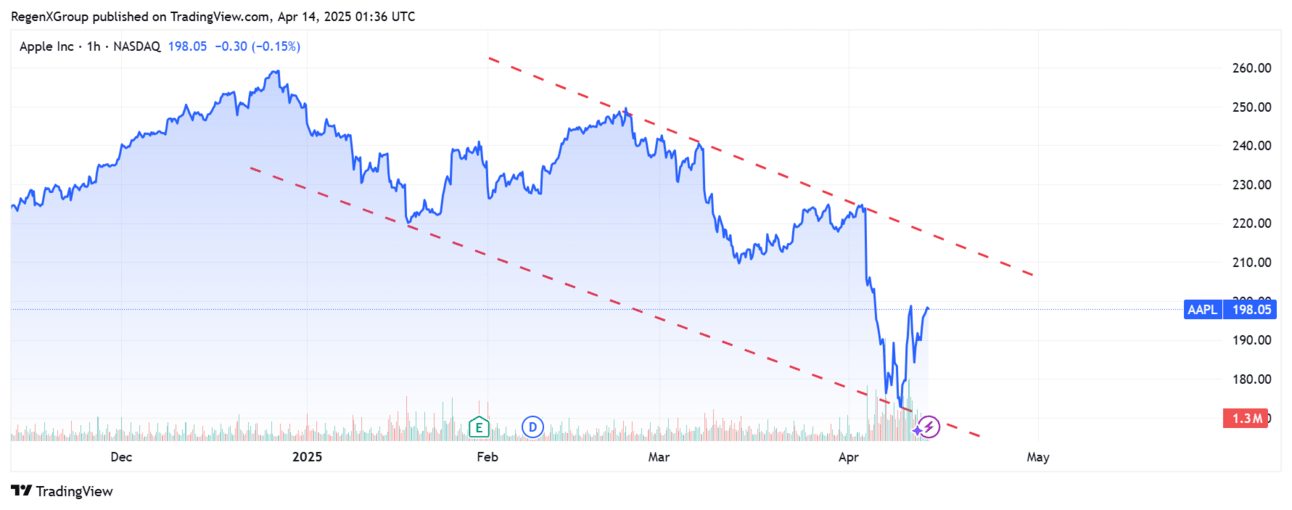

Is Apple a buy?

The recent fall in Apple shares due to trade tariffs with China, has prompted many to ask whether Apple is a buy, considering the recent drop. This Apple chart shows a clear downward channel forming since early 2025, with the stock recently rebounding off the lower bound and now trading around $198. While the broader trend remains bearish, there may be a short-term trading opportunity as the price moves from the lower end of the channel toward the mid-point or upper resistance line. However, until Apple breaks out above the top of this channel with strong volume, it's not considered a buy for longer-term investors. For now, it’s a potential swing trade, not a trend reversal.

TradingView

What’s happening in the world of RWA?

Tokenized assets have remained strong during recent market volatility.

Binance research shows Real World Assets (RWAs) were safer than Bitcoin during recent tariff-driven market turmoil.

RWAs are gaining interest because they combine real-world yield with innovative technology.

Big players are getting involved:

Apollo invested in Plume

WeBank launched the POTOS blockchain

Yala launched RealYield

Libertum is launching an RWA bonding DEX next month

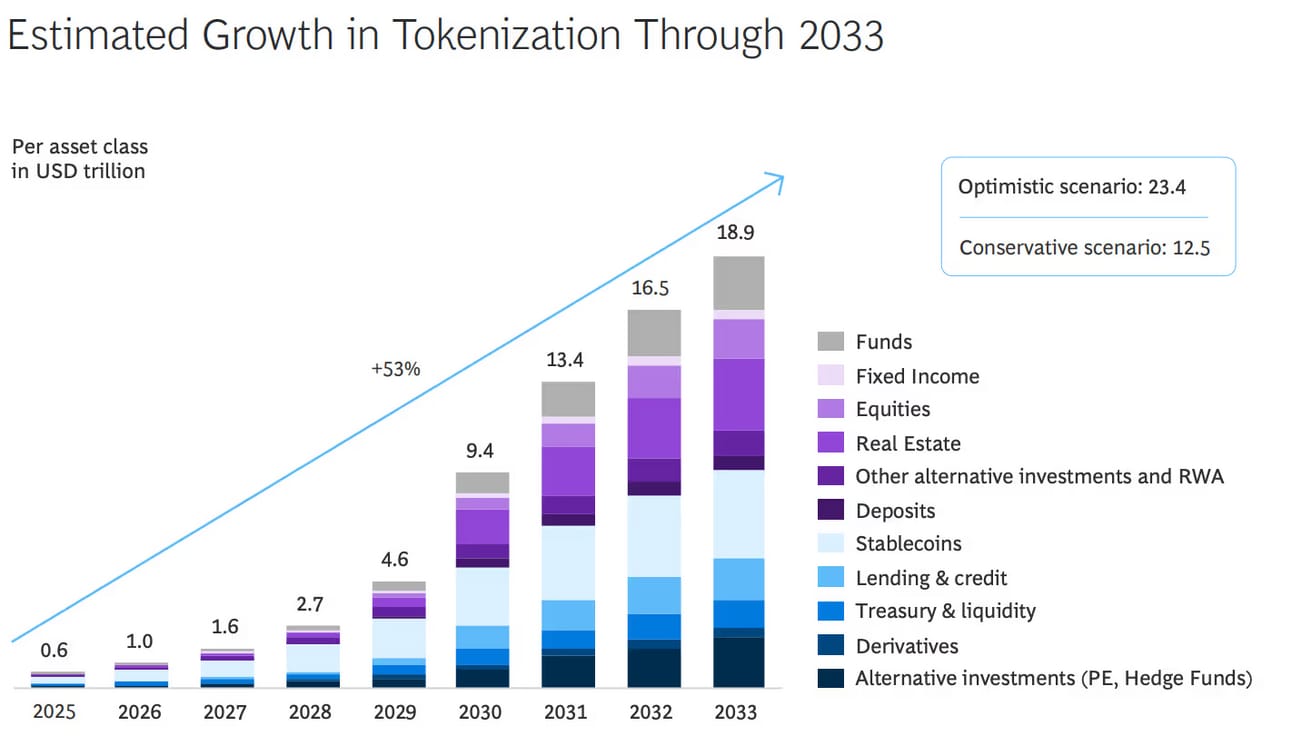

According to a report released by Ripple and BCG - The market of tokenized assets including stablecoins, is tipped to reach $18.9 trillion by 2033.

Report from Ripple & BCG

Is Trump crashing markets on purpose?

Source - New York Intelligencer

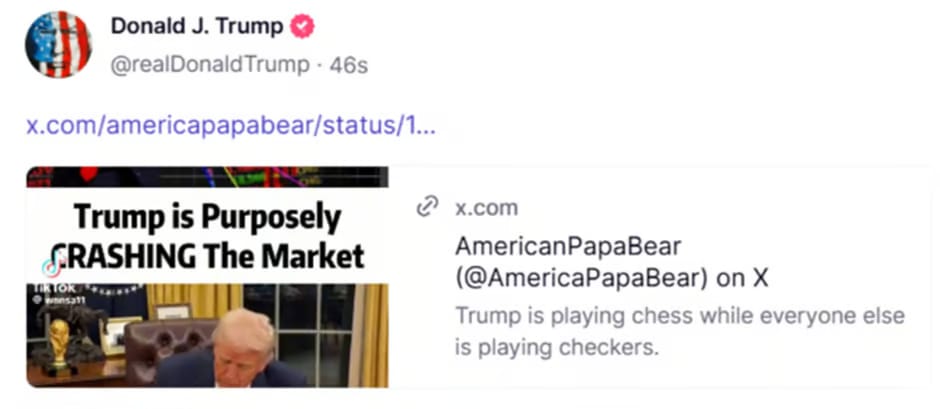

There's a theory doing the rounds, that Trump is purposely crashing markets to force the Fed's to lower rates. If so, will it work?

An interesting theory I heard today is that Trump is deliberately crashing the stock market to force the Federal Reserve’s hand.

Surely not... right?

At first, I dismissed it. But the more I thought about it, the more it started to make sense. During his last term, Trump made it clear he believes lower interest rates fuel economic growth. He regularly pressured the Fed to slash rates, arguing that cheap money boosts investment, supports the stock market, and benefits sectors like real estate, his own turf as a long-time property tycoon.

Fast forward to today, and Trump’s aggressive trade rhetoric and tariff threats have helped send the markets into a tailspin. The Dow, S&P 500, and Nasdaq have all taken heavy hits, especially stocks with exposure to China and global supply chains. It’s sparked geopolitical tension and dented investor confidence.

Then I saw one of Trump’s recent X posts and started wondering—maybe this is part of the plan. Goldman Sachs recently raised its U.S. recession forecast to 35% and now expects the Fed to cut interest rates in July, September, and November. Some traders are even pricing in up to four cuts this year to save the economy.

So, will it work?

Lower interest rates can certainly ease pressure on the economy. They make borrowing cheaper for households, businesses, and importantly, for the U.S. government, which faces massive bond repayments. It also helps Trump-aligned sectors like real estate, where debt costs are crucial. In this light, the strategy seems to be playing out exactly as intended.

But there’s a BIG problem with this theory.

By slapping tariffs on major trading partners, the U.S. risks global isolation. China has already rerouted LNG imports from the U.S. to Australia, while the EU and China explore ways to sidestep U.S. trade routes. That means lost exports, shrinking revenue, and diminished influence.

And investors hate uncertainty. Unpredictable policy, especially around trade, spooks markets and businesses. If companies can’t rely on stable rules, they’ll shift operations elsewhere. That means higher unemployment at home.

Worse, inflation is still elevated. Tariffs drive prices even higher. If the Fed cuts rates into that environment, it could fuel inflation further, weaken the dollar, and inflate asset bubbles.

The result? A perfect storm of slowing growth, rising prices, and job losses—better known as stagflation. Unlike a regular recession or inflation cycle, stagflation is hard to fix: trying to solve one problem often makes the other worse.

In theory, lower rates help the U.S. government refinance debt more cheaply. But if tariffs cause global retaliation and trade reroutes away from the U.S., revenues fall, supply chains suffer, and tax income shrinks, undermining the very reason for crashing markets and cutting rates in the first place: to ease pressure from rising bond interest payments.

So if this is Trump’s playbook, the cost of executing it could far outweigh the benefits.

Ishan

Australia Strikes Back at Trump’s Trade War with Major LNG Deal to China

As the US-China trade war escalates, Australia quietly seizes the opportunity with a landmark gas deal that signals a shift in global trade power

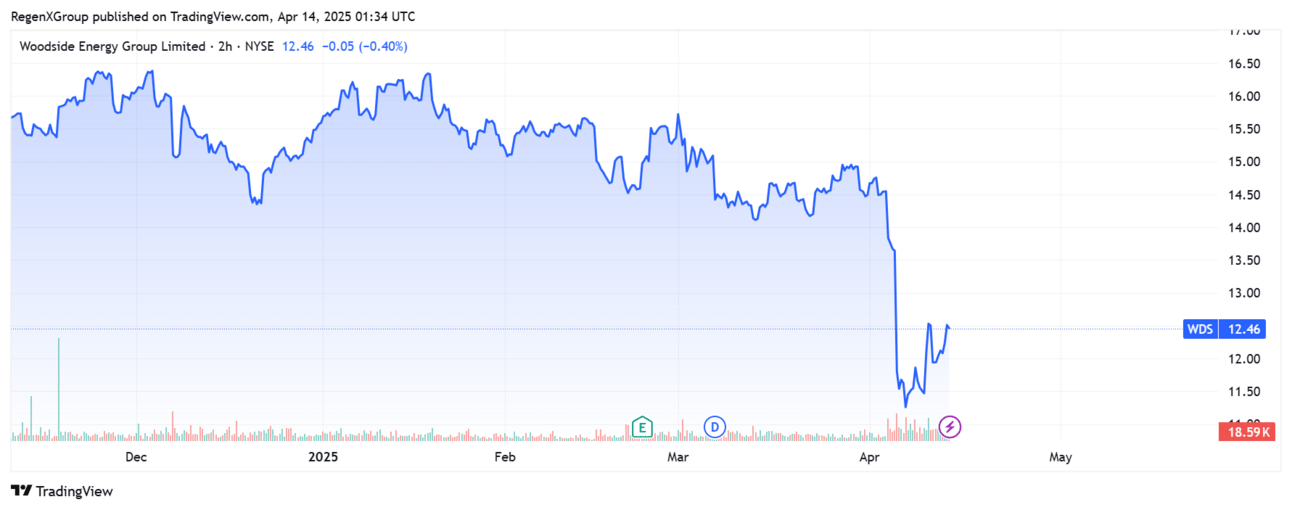

Australia strikes back with a big win in the middle of rising tensions between the US and China. Aussie energy company Woodside quietly signed a massive 15-year deal to sell liquefied natural gas (LNG) to China. Starting in 2027, Woodside will send about 0.6 million tonnes of LNG to China every year.

This is a big deal for a few reasons. It’s the first time Woodside has made a long-term deal like this directly with a Chinese customer. And it’s also the first time China Resources, one of China’s biggest gas companies, has agreed to buy gas from one company for such a long period.

But what’s bittersweet is the reason behind the deal. China has stopped importing gas from the US in a clear response to Trump’s tariffs. China hasn’t bought any LNG from America in over 60 days, the longest pause in five years.

Why? Because the US, under President Donald Trump, raised tariffs on Chinese goods. In retaliation, China hit back with a 34% tariff on US gas, making it far too expensive for Chinese buyers.

Head of China Gas Research at Rystad Energy, Wei Xiong said, “With the US-China energy corridor frozen, Chinese firms are looking elsewhere to secure long-term supply — and Australia is stepping in to fill the gap.”

Woodside’s Executive Vice President Mark Abbotsford was optimistic about the deal. “This agreement shows the long-term commitment in Asia to secure reliable energy,” he said. “We’re proud to begin our relationship with China Resources, the country’s leading gas utility.”

Because China doesn’t need gas from the US right now, they’ve been selling some of their existing US supply to Europe, which is great news for European countries still trying to replace the gas they used to get from Russia.

This latest LNG deal between Australia and China may be just the beginning of a global reshuffle in trade alliances. Reading headlines this morning, Trump has ramped up threats of even harsher tariffs, now floating a 50% tariff on Chinese goods if Beijing doesn't back down.

China is clearly looking for new, more stable partners, and Australia, with its reliable energy exports and less volatile political climate, is well positioned to step in and fill the gap. While the US and China continue their tit for tat standoff, this is a perfect opportunity for Australia to gain not just from trade deals, but also from growing our importance in a rapidly changing global order.

While this trade war has shaken the world to its core, Australia has stepped up and locked in the first big win.

TradingView

RegenX is pitching at Decarb Pitch Fest #2

EnergyLab is Australia’s largest climate tech startup accelerator. The Decarb Pitch Fest showcases the startups from Cohort 2 of EnergyLab's Investment Ready Program for Queensland climate tech founders. This event brings together investors, startups, and the wider Queensland climate tech ecosystem.

Event schedule

5:30pm: Complimentary food and drinks

6:00: Startup pitches

7:30: Networking

8:30: Event finishes

Startups pitching:

Bitpool (Ben Carter & David Blanch) is a Building Intelligence Platform optimising clients’ performance, cutting their costs, and reducing their carbon footprint.

Gate 46 (Joshua Savage & Damien Stone) provides waste-to-energy technologies and sustainable agricultural practices for dairy farms.

Genevo Marine (Damon Rahmate & Andrew Davey) is on the path to become Australia’s first fully electric production speed-boat and drive train.

InfigoLabs (Prashant Parulekar) uses zero-emission high temperature flame of steam to create value in high-yield, coke-free ethylene production and to complete PFAS (forever chemicals) destruction.

Methane Intel (Geoff Osborn) provides integrated satellite and sensor-based site methane reporting for coal, gas, landfill, and feedlot industries.

Ocean Orchards (Adrian Spierings & Anna Hendra) turns pond slime into a high value cosmetic extract, a tasteless plant-based protein powder, and carbon negative concrete. All at the same time.

RegenX (Ishan Dan) is a tokenised investment platform helping impact investors access verified green projects with transparency and trust.

Sequestra (Warwick Anderson & Sheree Anderson) creates carbon credits through self-sustaining ecosystems that regenerate land, improves soil health, and drive economic value.

Squirrel Energy (Joris Eerkens) is a vertically integrated developer, builder, and operator of sub-5 MW Battery Energy Storage System (BESS) with a focus on AI-driven energy trading.

Swapping Chain (Nic Robertson) is an algorithm-driven swapping platform unlocking the hidden value in dormant goods.

Tera (Lachlan Jeremijenko & Rochelle Caron) provides a hardware solution that transforms CO2 emissions from existing industrial processes into useful carbon products.

Huge thanks to EnergyLab for the opportunity to pitch at Decarb Pitch Fest #2—we're incredibly pumped to be part of such a high-impact cohort. If you're in Queensland, come along to The Precinct on May 1st, meet some amazing climate tech founders, and say hi. Let’s decarb together.

Here's the ticket link for the upcoming Decarb Pitch Fest #2: https://events.humanitix.com/decarb-pitch-fest-2

Read more about the cohort here: https://shorturl.at/ZLv5O

Thanks for reading this week’s edition of the ReFi Playbook. I appreciate you being part of this growing community of builders, investors, and changemakers shaping the future of climate finance. If you found value here, feel free to forward it to a friend or colleague who might be curious about the world of tokenized RWAs and regenerative finance. And if you haven’t already, make sure to subscribe so you don’t miss the next drop. Until then, stay curious, stay regenerative. 🌱

Ishan

Founder, RegenX