- The ReFi Playbook

- Posts

- What is Earnings Season and Why Does It Matter?

What is Earnings Season and Why Does It Matter?

As the US enters earnings season this week, it's important that investors understand the importance of earning season and how it affects company share prices.

If you're an investor or just starting to explore the stock markets / crypto markets, there’s one term you’ll hear a lot: Earnings season. And guess what? It’s happening right now.

So, what exactly is earnings season?

Unlike Australia, in the US publicly listed companies report their financial performance every three months in what's known as quarterly earnings, aligned with the calendar year: Q1 (Jan–Mar), Q2 (Apr–Jun), Q3 (Jul–Sep), and Q4 (Oct–Dec). This means investors receive updates four times a year on how a company is performing and how much money they made (or lost). This includes things like sales (revenue), profit (net income), and their plans for the future. These reports play a huge role in what happens to a company’s stock price.

Why Earnings Matter

Every quarter, analysts and stockbroking houses publish their best guesses, called earnings estimates for how much profit a company will earn per share (EPS). This is the magic number. In Australia, we look at the NPAT (Net Profit After Tax). If a company beats those expectations, the stock often jumps. But if it misses, the price tanks to reflect the lower earnings.

For investors, earnings give insights into how the company is doing and whether its growth story is on track. For traders, it’s all about the surprise: beat the estimate and the stock usually rallies, miss it and it drops.

Tesla Example: What to Watch

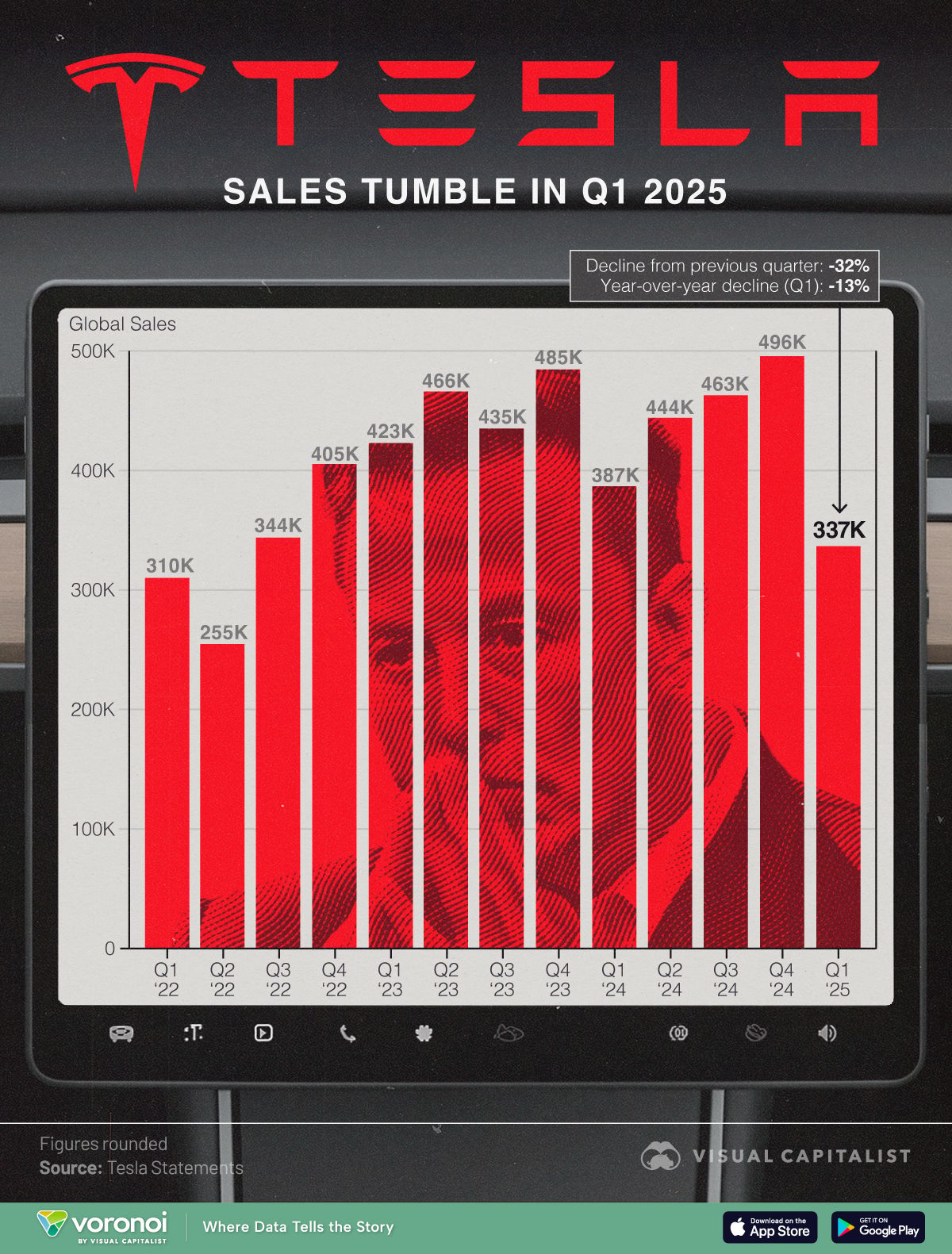

Source - VisualCapitalist

Let’s look at Tesla.

Tesla is set to report earnings on April 22, 2025, after the market closes. This will cover the first quarter of 2025. According to Zacks Investment Research, analysts expect Tesla to report earnings per share (EPS) of $0.36.

Now, here’s why that’s important:

If Tesla reports more than $0.36 in earnings, investors might see it as a bullish signal, especially if revenue also climbs.

If the number comes in below $0.36, or if they signal weak sales or lower margins, the stock could sell off.

Either way, the report will almost certainly move the stock price — and traders will be watching closely due to the global drop in sales volumes.

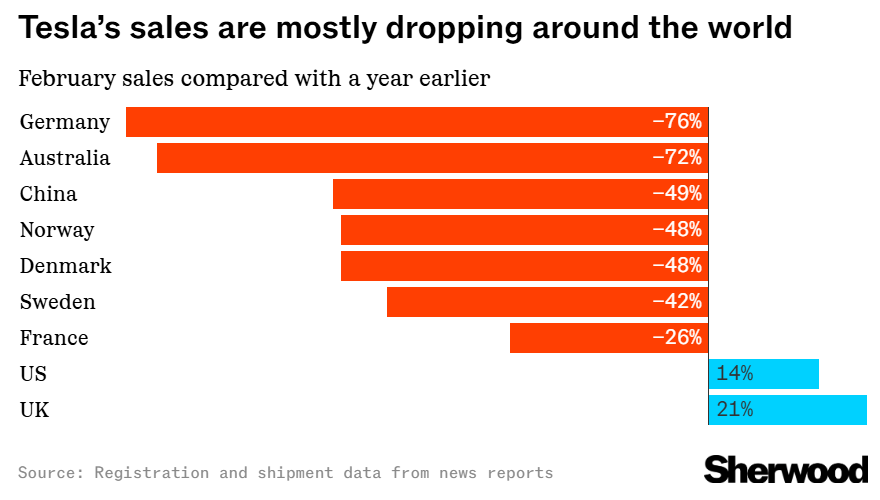

Source - Sherwood

Beyond just EPS, investors will look for updates on vehicle deliveries, margins, EV pricing strategy, and any news around AI, Robotaxis or Dojo (Tesla’s in-house supercomputer). This context can shape how people value the company in the long run.

Who Else Reports This Week?

Source Earnings Whispers

Other big names reporting include Netflix, Johnson & Johnson, Bank of America, Alcoa, and TSMC. From financial giants to tech leaders, these earnings paint a picture of how different sectors are performing.

How to Quickly Read an Earnings Report

Short on time? Focus on three key things:

EPS vs. Consensus Estimate – Did they beat or miss?

Revenue Growth – Are sales up or down?

Guidance – What does management expect for the next quarter?

Final Thought

Earnings season is like report card time for companies, and stock prices react accordingly. Whether you’re already investing or just watching and learning, this is a great time to build your market knowledge.

So keep an eye on Tesla next week, whether they beat, miss, or surprise, it’ll give you a front-row look at how earnings shape the market.