- The ReFi Playbook

- Posts

- Why Australia is the Ideal Location for Cryptocurrency Startups

Why Australia is the Ideal Location for Cryptocurrency Startups

Australia presents an attractive location for start-ups seeking to foster innovation.

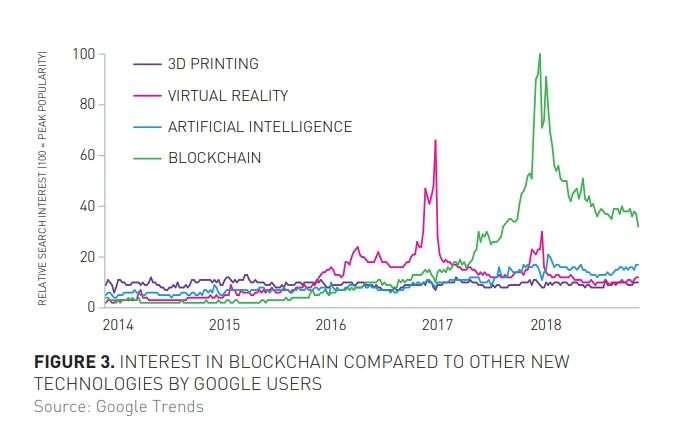

Blockchain has become one of the most talked about technologies in recent times, spreading to every corner of the globe catalysed by a growing surge in demand and interest. This rise caused a lift in Australian blockchain activities with over 50% of activities undertaken by blockchain firms and start-ups.

Australia presents an attractive location for start-ups seeking to foster innovation. Its distinct ecosystem is characterised by pro-business policies, stringent compliance and regulations that protect consumers from corruption and fraud. A resilient banking system, and a supportive investor community have helped create a dependable banking system that provides investors with an opportunity to establish a strong presence and a notable advantage over other new blockchain startups that seek to gain a competitive edge in this region.

By establishing a presence in Australia, a startup could connect with one of the “Big Four” banks, thereby granting it global commercial reach and increased visibility. Trading platform OKX recently expanded its operations in Australia, a country it believes is “primed to take on the next wave of crypto adoption.”

In a statement, the company said, “We see Australia as an indispensable part of this strategy and a key growth market. With such a strong uptake of crypto in Australia already, we’re committed to the local market and aim to build a strong local office.”

One of the key reasons OKX setup shop in Australia is the country’s high rate of adoption for crypto investing and trading compared to the rest of the world. Despite the operational and regulatory uncertainties that plague crypto, awareness and adoption in Australia are increasing yearly. According to a report by The Independent Reserve Cryptocurrency Index (IRCI), 28.8% of Australians own or have owned cryptocurrencies as of December 2021. Between 2020 and 2021, cryptocurrency adoption jumped 56% with Bitcoin is the most popular crypto in Australia.

Another report put together by Finder showed that crypto adoption rates were at 23% putting Australia in 3rd place in crypto adoption among a list of 27 countries studied. Well above the global average which is just above 15%. And so, this places Australia high on the list of countries earmarked for expansion plans.

A recent survey from Australian crypto exchange Swyftx found that about 1 million Australians are expected to enter into cryptocurrency space for the first time within the next 12 months, which represents about 4% of the country’s population.

.png/:/cr=t:0%25,l:0%25,w:100%25,h:100%25/rs=w:1280)

Australia stands out not only for its high crypto adoption rate but also for its tech-savvy and innovative environment. The country’s dedication to curbing carbon emissions and mitigating climate change is in line with the objectives of numerous local startups.

Australia’s easy-to-do-business environment, cost-effectiveness, and government support make it a desirable option for expanding operations. All these factors make Australia the ideal location for any startup to setup shop. Here are a few dot points as to why Australia is a prime location to setup shop:

Regulatory clarity: Australia has a relatively clear regulatory framework for cryptocurrencies and blockchain technology, which could provide greater certainty and stability when operating in the market.

High adoption rate: Australia has a high level of technology adoption and a growing interest in cryptocurrency and blockchain, which could provide a strong user base for products and services.

Strategic location: Australia’s location in the Asia-Pacific region could provide a strategic base for expanding into other markets in the region, such as Southeast Asia.

Supportive ecosystem: Australia has a strong startup ecosystem and is home to a number of blockchain and cryptocurrency startups, which could provide access to talent, funding, and partnerships.

Easy Access – To decentralised, fully dematerialised set of capital markets, making it easier to implement blockchain solutions relative to places like the US or EU.

Government funding for research into blockchain uses in the public sector.

A strong financial services industry that weathered the global financial crisis better than almost anywhere else in the world.

Australia is chairing the International Standards Organisation group developing standards for blockchains and other distributed ledgers.

The demand for blockchain-related jobs and skills has increased significantly, especially in Australia. This sustained growth in demand is evident, with close to 60% of blockchain-related jobs in Australia paying over AUD$100k per year. While the supply of blockchain-related skills has also increased, it is not keeping up with demand, resulting in 14 job openings for every available candidate.

Additionally, Australia’s highly supportive government makes it an ideal location for startups to expand their operations. The number of companies operating in blockchain and cryptocurrency in Australia soared by 153% in 2020, and industry players are expected to contribute over US$175 billion to the global annual business value by 2025. With Blockchain and DLT disrupting markets in Australia, the opportunity cost of not expanding in Australia is too high for startups to ignore.